Cross-Venue Intelligence | Smart Order Routing | AI-enhanced Reporting

Turn MM and broker fees into your savings.

Built for crypto foundations and digital-asset hedge funds to optimize execution costs.

Three core capabilities. One mission

Transparency

KLONDIKE shows you the real market, so you can renegotiate or replace on fair terms.

Three core capabilities. One mission

Transparency

KLONDIKE shows you the real market, so you can renegotiate or replace on fair terms.

Why Klondike

Control Your Execution Layer

Place spot orders across 60+ centralized exchanges from a single interface. Assets remain in exchange accounts you control.

- Multi-CEX order placement

- Smart order routing

- Full execution audit trail

Real-Time Execution Analysis

Measure slippage, market impact, and execution quality across 60+ venues. Prove whether your execution was fair relative to all observable liquidity.

- Aggregated cross-venue order books

- Live liquidity snapshots

- Counterfactual best-execution simulation

Understand Your Markets in Plain English

Connect Klondike to Claude and ask: “Was my execution fair?” We translate real-time cross-exchange data into clear, data-backed answers.

- LLM integration (Claude)

- Institutional-grade analytics

For Crypto Foundations

THE PROBLEM:

Your token trades across several exchanges.

You rely on market makers without verification.

- MM Oversight: Detect markup and poor execution

- Market Impact: Quantify slippage across venues

- AI Assistant: Explain price moves in plain English

Independent visibility into liquidity, pricing fairness, and execution quality across the full market.

For Digital-Asset Hedge Funds

THE PROBLEM:

Crypto liquidity is fragmented across 60+ exchanges.

Manual aggregation is unrealistic at scale.

- Execution Analytics: Measure slippage & market impact

- Best-Execution Proof: Benchmark trades across venues

- Smart Routing: Optimize execution costs

On a $50M order, optimized routing can reduce execution cost by 15–25 bps versus single-venue trading.

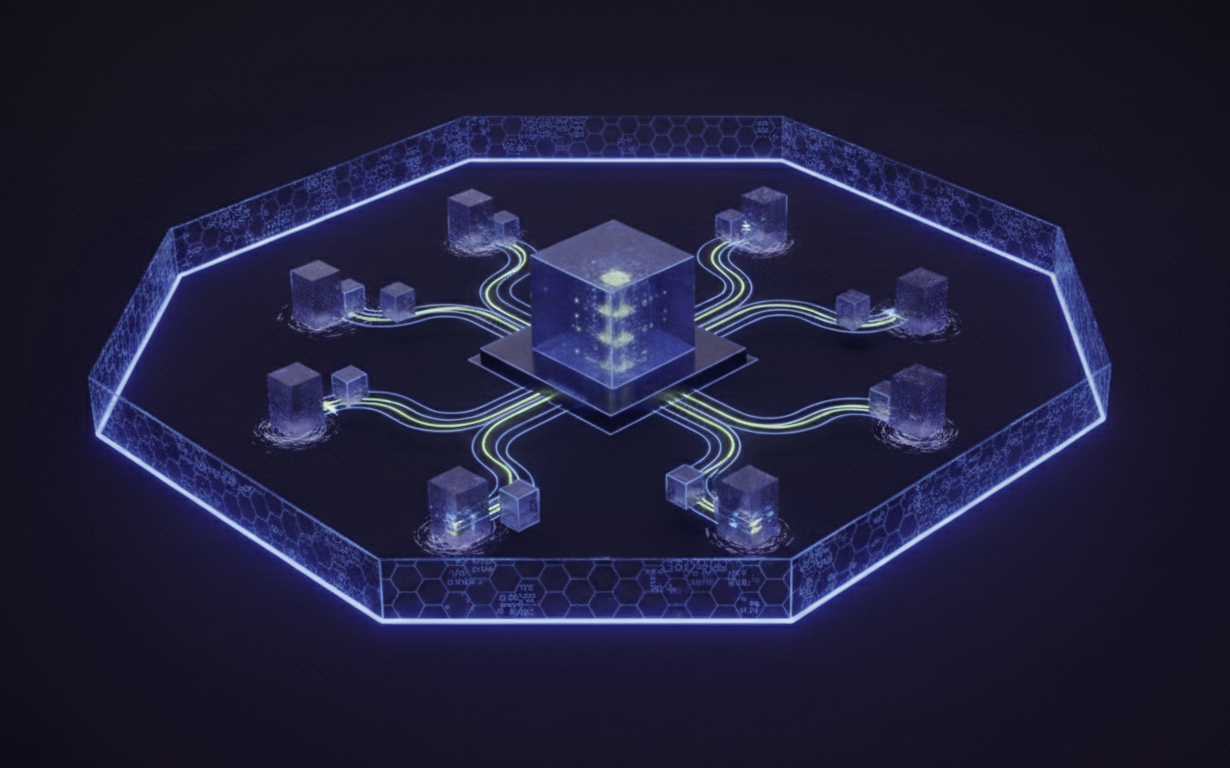

Global Order Book

Real-Time Venue Aggregation

Merges live bid-ask data from 60+ centralized exchanges into a single, unified order book. See the tightest spreads and deepest aggregated liquidity across venues

metrics:

– Best bid/offer across all venues

– Aggregated depth (±1%, ±2%)

– Volume-weighted mid-price

Market Impact

Execution Quality Analysis

Simulates execution across all 60+ venues and compares the simulated optimal price to the price you actually paid. Quantifies slippage and potential market maker markup.

Trade Analyzed: ALGORAND/USDT

– You sold: 10,000 ALGO

– Your MM price: $0.96 ($9,600)

– Optimal routing: $0.98 ($9,800)

– Your markup: $200 (2%)

Options Pricer

Fair Valuation for Structured Contracts

Values token options using market data. Identify unpriced optionality embedded in market maker agreements.

Klondike Valuation:

– Call option intrinsic value: $0

– Time value (Black-Scholes): $1.8M

– MM Ask: $4.8M vs Fair Price: $3.8M

-> Recommendation: Review pricing terms.

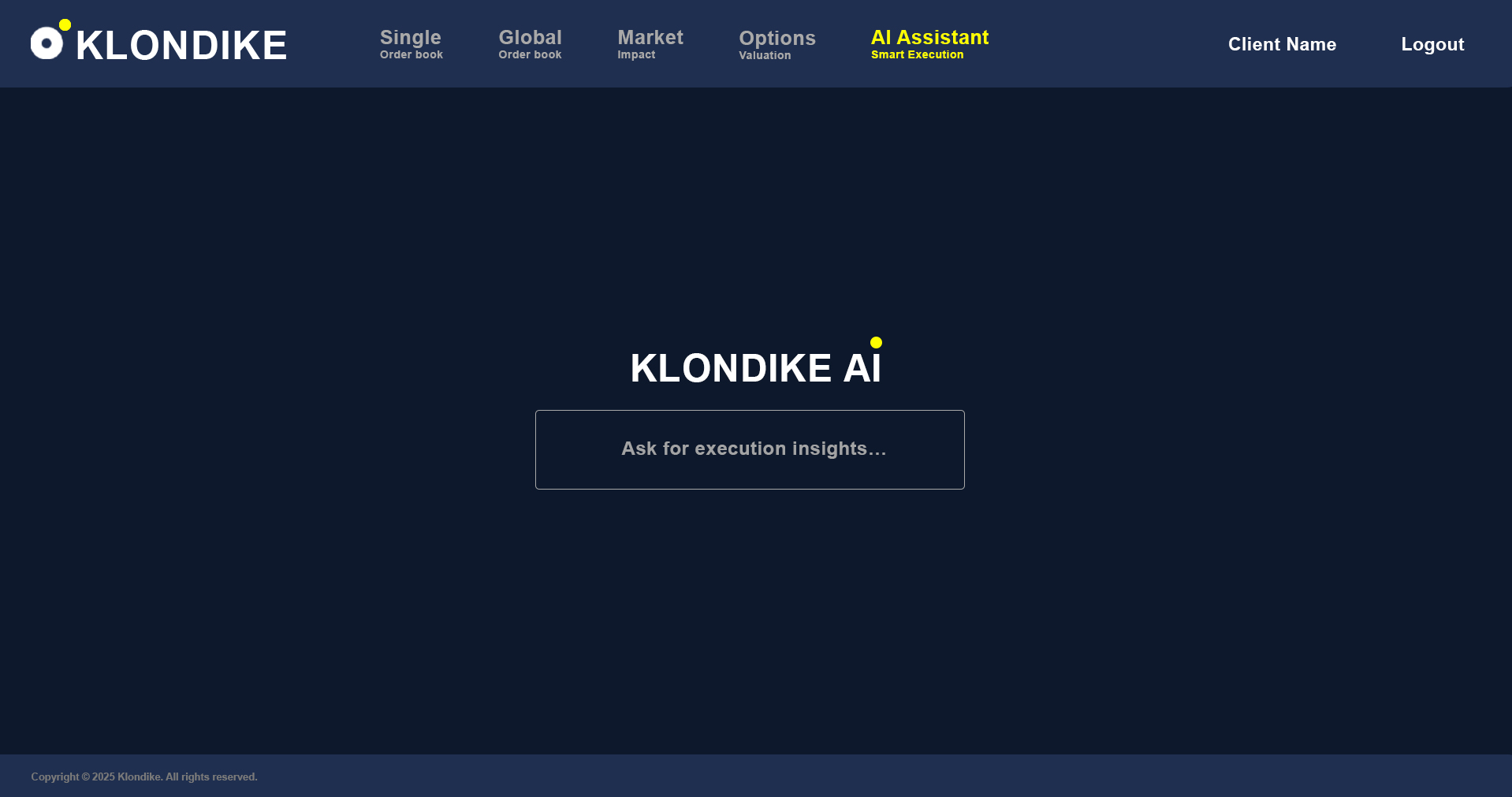

AI Assistant

Natural-Language Analytics

Connect Klondike’s market data to Claude via MCP. Ask questions in plain English and receive data-backed answers.

USER: Did my market maker provide a fair execution price?

AI: Optimal routing was $1.28. You received $1.23. This reflects 4% slippage versus aggregated liquidity.

Execution

Smart Multi-Exchange Routing

Route orders across 60+ centralized and hybrid exchanges from a single interface.

Optimize liquidity, fees, and market impact in real time with no custody or counterparty risk.

- Place spot orders (Immediate Or Cancel) across multiple venues

- Settlement directly on exchange accounts you control

- Admin/Trader role separation

Pricing

Analytics

€5,000/month

_____________________

Analytics & AI insights.

No execution.

_____________________

- Global Order Book

- Market Impact Analysis

- Options Pricer

- AI Assistant

Analytics + Execution

€10,000/month

_____________________

Full platform:

Market intelligence + live execution.

_____________________

- All Analytics Features

- Multi-CEX Order Execution

- Immediate Or Cancel (IOC) Orders

Analytics

€5,000/month

_____________________

Analytics & insights only.

No execution.

_____________________

- Global Order Book

- Market Impact Analysis

- Options Pricer

- AI Assistant

- Unlimited users

Execution

€10,000/month

_____________________

Full platform:

Market intelligence + live execution.

_____________________

- All MVP1 Features

- Multi-CEX Order Execution

- Real Trading (IOC)

- Audit Trail

- Position Aggregation

Get Started Today

Choose how you’d like to experience Klondike.

Request Demo